The economic confrontation between Russia and Western countries since the beginning of the war in Ukraine has already led to a global energy crisis. In terms of its scale, it may well surpass the consequences of the 1973 oil embargo. Many experts agree that the coming winter will see the biggest energy crisis for Europe. Under the worst-case scenario, residents of some countries may be left with little or no heating during the winter and some businesses will be forced to shut down. At the same time, Europe's desire not to depend on Russian gas should accelerate its transition to clean energy.

Content

European Union: Worst-case scenario

Revisiting the green program

Not everyone loses

Global energy transition will follow a different scenario

The attack on Ukraine and retaliatory sanctions by the EU and the U.S. have led to an intensified energy confrontation: the West uses oil and coal in this struggle, minimizing imports of these energy resources from Russia, while the Kremlin uses the gas pipe, since Russia is not as dependent on natural gas trade (only 20% of all oil and gas revenues come from gas). The Kremlin propaganda has been churning out stories about how Europe will freeze to death without Russian gas for years, but this time the EU really needs to prepare for the worst. Many experts agree that the coming winter will be Europe's biggest energy crisis. So far, Brussels has not given any detailed statistics or a road map with specific solutions for industries and countries, but some forecasts can still be made.

European Union: Worst-case scenario

Until 2022 Russia was the leading supplier of gas to the EU accounting for up to 45% of all imports. Only European companies, which have been trying to increase gas production this year (even at the expense of reducing oil production), accounted for a slightly larger share of supplies to the market. Amid energy shortages caused by disruptions to Russian gas supplies, European regulators will most likely have to choose which consumers should be supported or even «allowed to exist.»

The European Commission has already adopted an agreement to reduce gas consumption by 15% over the next eight months, commencing from August 1. This should save up to 30 billion cubic meters of fuel, help European countries to pump the necessary volume of gas into their underground storage facilities by November 1 and supposedly survive an «average» winter. However, this volume may not be enough for EU needs, especially if temperatures are abnormally low.

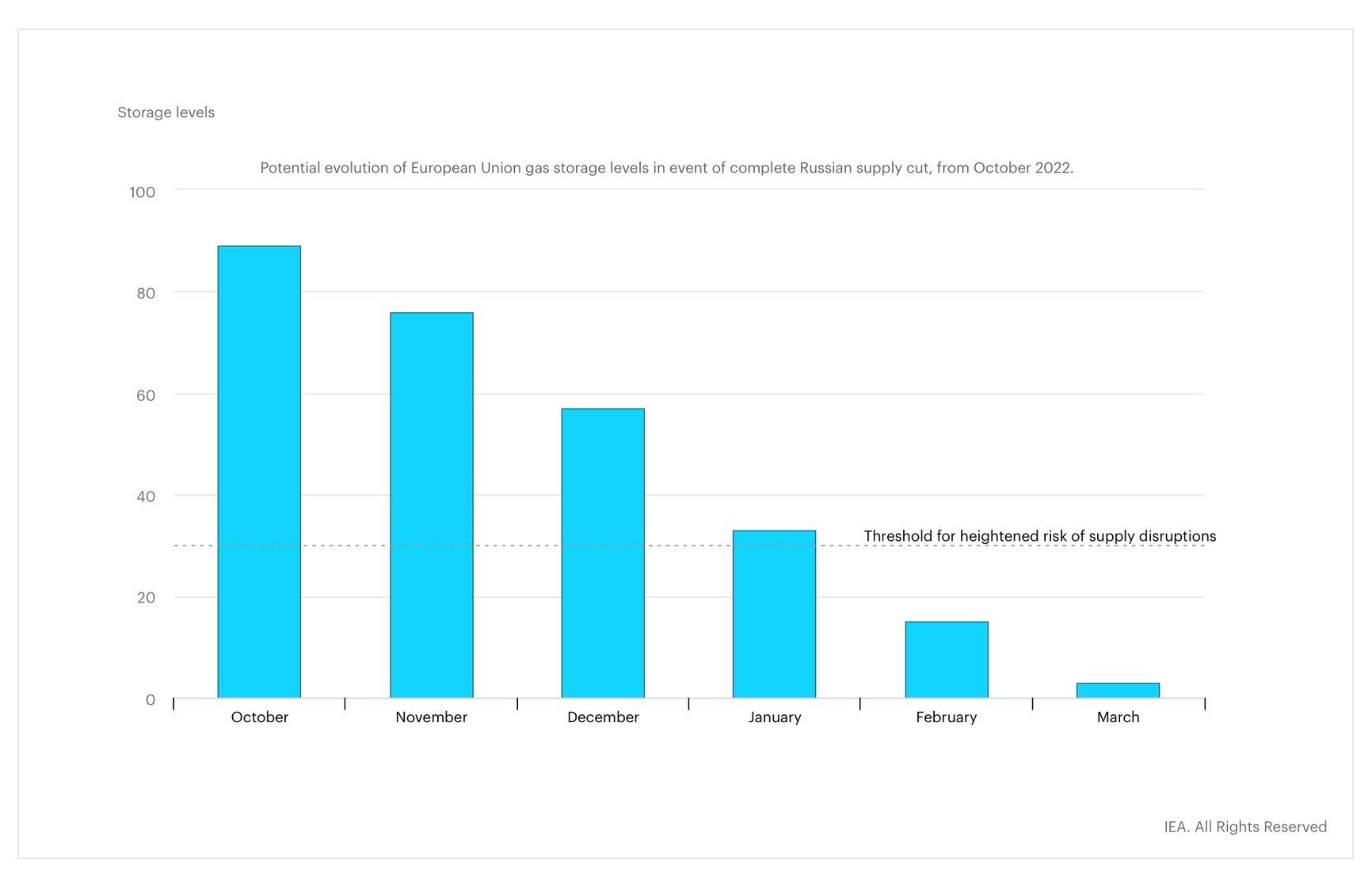

According to the estimates of the International Energy Agency (IEA), even if the gas storage facilities are 90 percent full by winter, a shortage of gas in Europe may occur by February if Russian supplies stop altogether. If temperatures in Europe remain below normal this winter, the European countries will need around 350 million cubic meters of Russian gas per day.

Even if the gas storages facilities are 90 percent full by winter, a total halt in Russian gas supplies to Europe could create a gas shortage as early as February

Hungary, Slovakia and the Czech Republic deep inside the continent may turn out to be the most vulnerable, while Austria, Germany and Italy will feel the negative effect to a lesser degree. The reason is that the European gas distribution network was originally built to bring gas from Russia to the consumption centers in Central and Western Europe.

Problems may arise because countries and companies are not ready to switch between energy sources. Another problem could be associated with the limited capacity to transport gas from alternative sources (e.g. LNG terminals) through certain regional distribution systems.

Obviously, countries that have access to the liquefied natural gas market (mainly Southwestern and Western Europe) will be less affected. But LNG prices will also rise in anticipation of winter. There will probably be a number of even poorer countries, such as Pakistan, which will not be able to compete for raw materials and will experience the energy crisis “on the ricochet», even though they are on the other side of the world.

For some industries (for example, chemical industry where gas is used as raw feed for production) supplies are critical and disruptions may lead to serious losses up to shutting down of plants, while other industries which need gas for energy generation are likely to reduce gas production and consumption.

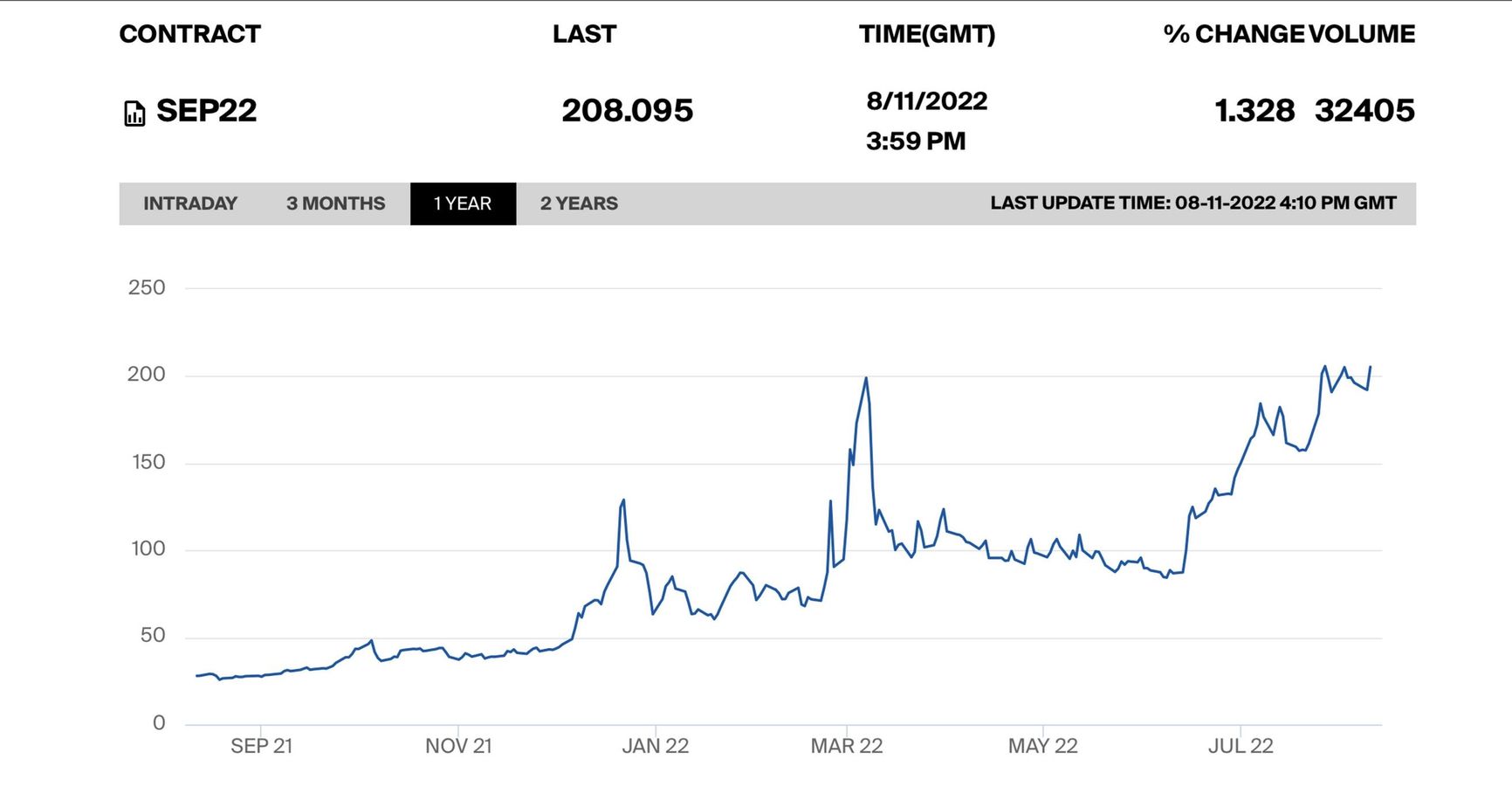

According to IMF analysts, a complete cessation of Russian gas supplies across Europe for more than six months would expose «infrastructure bottlenecks» and thereby lead to even higher gas prices and significant shortages in the most vulnerable countries. And this despite the fact that the price of gas in Europe has already begun to break records since the outbreak of hostilities in Ukraine, and the reduction of supplies through Nord Stream 1 to 20% since late July has only fueled demand.

Gas price in Europe over the last 2 years

Revisiting the green program

In mid-May, the European Commission presented its strategic response to the energy crisis - the REPowerEU plan. According to the plan, the EU's dependence on Russian gas must decrease by 67% this year and be fully eliminated «well before 2030».

In 2020, the share of renewable energy sources in the EU balance was over 22%. This figure was originally planned to rise to 40% by 2030, but according to REPowerEU, it is supposed to reach 45%. In particular, the focus will be on the fast-growing market for solar panels. By 2025, their number should double compared to the current level - up to 320 GW, and should reach 600 GW by 2030.

“Green” hydrogen will play the leading role in gas phase-out. The main advantage of green hydrogen is that it can be delivered to the infrastructure bottlenecks in Central Europe. The goal of REPowerEU is to produce 10 million tons of hydrogen inside the EU and import the same amount by 2030.

Wind and hydroelectricity accounted for more than two-thirds of all electricity generated from renewable sources (36% and 33%, respectively). The remaining third came from solar power (14%), solid biofuels (8%), and other renewable sources (8%). Solar energy is the fastest-growing source: in 2008, it accounted for only 1% of electricity consumed in the EU.

In particular, the focus in green energy will be on solar panels as the fastest growing market.

The EU's second challenge is to achieve all this taking into account its ambitious climate goals. And the European Commission expects an acceleration in achieving many parameters.

The EU countries want to achieve the planned goals by saving energy, diversifying energy supplies, and accelerating work on renewable energy sources (RES). So far, the path that the EU has been following evidences the priority of the first task over the second.

This year, the EU's dependence on Russian gas is expected to decrease by 67 percent

For example, the EU green taxonomy (the list of projects for investment according to the EU green strategy) has been amended amid the energy crisis to include atom and gas, which is controversial from the point of view of safety and carbon footprint. This will lead to renewed investments in those sectors over the next few years and the emergence of infrastructure for the wider use of liquefied natural gas in Europe.

The decision has drawn criticism from eco-activists, but supporters are calling for nuclear power and gas to be treated as «intermediate» energy resources in the transition to renewables. The Greens are also unhappy about the plans of Germany and Belgium to postpone the mothballing of their nuclear power plants amid the energy crisis. In their opinion, those plans delay the transition to clean energy sources and lead to ineffective investments in outdated industries.

Nor will the embargo on Russian coal lead to a sharp decrease in its consumption in the EU. Before the restrictions, European buyers tried to increase coal shipments during the spring and found new importers like Kazakhstan, Indonesia, Australia, South Africa and Colombia.

The embargo on Russian coal will not lead to its lower consumption in the EU

But despite those «steps backward» and the temporary use of non-environmentally friendly fossil fuels for a couple of years, Europe's fierce desire to shed its dependence on Russian gas should accelerate its transition to clean energy. Trying to strike a balance between tactical and strategic prosperity, the European Commission is now essentially choosing between simply enduring one or two hard winters or investing more in renewable sources and thereby being able to fit into the short and fast-closing window of relative climate prosperity.

Not everyone loses

The surge in energy prices is also pushing up supplier revenues, encouraging them to increase production and exports. For example, it was one of the reasons for the 580% increase in Iran's oil and condensate revenues between March and July. But perhaps the biggest «premium» under the current circumstances is being received by the U.S., and on several fronts at once. Oil exports from the US are breaking historical records (more than 4.5 million barrels per day) and, according to analysts' estimates, the growth may continue.

The situation is the same with liquefied natural gas: based on the results of the first half of 2022, the U.S. has become the world’s largest LNG exporter, increasing exports to the EU and Britain by 63%. Supplies could grow even more if European buyers continue to offer an order of magnitude more for LNG shipments than their Asian competitors. But U.S. gas will not be an absolute solution for Europe in a crisis because LNG supplies are limited by the availability of infrastructure.

U.S. oil exports have been breaking historical records

Despite the obvious benefits for U.S. hydrocarbon suppliers, in the long run a slowdown in the economic development of the European Union, a key U.S. partner, let alone a threat to its political cohesion, is hardly among U.S. foreign policy goals. Also, the U.S. and the EU are unlikely to be satisfied with a strengthening of China’s economy, which is actively importing oil from Russia at a huge discount because of its toxicity, as well as natural gas. It will not come as a surprise if in the future China as a key buyer demands even more privileged price terms from Russia.

As for Russia's second major oil buyer, India, the question is whether the U.S. and Britain will actually be able and willing to try to hook India into the oil embargo. On the one hand, about 1 million barrels per day of Russian oil will be left without a buyer; on the other hand, China will most likely buy the oil instead.

Persian Gulf countries, in particular the UAE, have significantly ramped up their imports of Russian oil products

Middle Eastern exporters who have lost their leadership on the traditional Asian market have increased their supplies to European countries and found a new trading niche - Russian oil products. Persian Gulf countries, in particular the UAE, have significantly increased their imports of Russian oil products, especially dark hydrocarbons used in the shipbuilding industry and for power generation. According to Vortexa, the volume of purchases in July was close to 400,000 barrels per day.

In addition, Turkey can be one of the non-obvious beneficiary buyers. It has been actively buying up cheaper Russian oil in the Mediterranean and has generally taken an intermediary’s position in Russia's conflict with Ukraine.

And, of course, oil and gas companies around the world have gained record-high profits from the unfolding crisis. UN Secretary General Antonio Guterres says he considers the existing state of affairs as “immoral.”

“The combined profits of the largest energy companies in the first quarter of this year are close to $100 billion. I urge all governments to tax these excessive profits and use the funds to support the most vulnerable people through these difficult times.”

Global energy transition will follow a different scenario

The last five months since the start of the war in Ukraine have already changed the global energy market quite a bit, but the changes to come will be even more noticeable.

As with the 1973 crisis, consumer countries are likely to rethink their approach to energy purchases toward even greater diversification of energy sources and suppliers. In addition, developed countries will try to accelerate the energy transition and decarbonize their economies, as climate change and even more alarming forecasts push them to do so.

The only question is the trajectory that the process will take. But it is already clear that security, and not just economic well-being as has been the case over the past decades, will be at the top of the agenda.

On the one hand, it may lead to a strengthening of centripetal forces in politics and the economy, a slowing down of the globalization process, and attempts to reduce dependence on suppliers of key products and technologies in particular. But on the other hand, as a result of the process, technologically advanced countries will increasingly strengthen their positions, as opposed to resource-supplying countries, and in the long run, technological dominance should ensure more stable prices and energy security.