Despite formal indications of growth in the Russian economy, many of its flagship firms are experiencing serious problems, reports from key Russian companies show. Businesses are losing markets. They face rising costs due to logistical problems and exchange rate fluctuations. And their debts are mounting. In response, major players like Gazprom, Nornickel, and Rusal have suspended dividend payments, while others are asking for help from the state, considering relocating their operations to China, and passing on costs to Russian consumers.

Content

Gazprom is now an oil company

Debt-ridden and bonus-less Aeroflot

Rusal asks for help from the government

Nornickel brings copper to China

Who’s better off?

According to official reports, the Russian economy is growing. But that doesn’t mean it is healthy. Oleg Vyugin, a professor at Moscow’s Higher School of Economics, describes the country as “turning into a cauldron,” isolated from the outside world’s sanctions, yet flush with cash. Under these conditions, some businesses are indeed thriving. Others, however, find themselves competing in a wage race for suddenly scarce workers, scrambling to find buyers after losing international clients, and cutting costs by halting dividend payments to shareholders.

The situation varies even within similar sectors. The oil industry, buoyed by high prices, appears relatively successful — as can be seen from state giant Rosneft's official statistics. In contrast, gas producers are struggling. It is far from easy to get a general view of corporate health in Russia: some companies have stopped publishing reports altogether, or have provided limited data since the start of Russia’s full-scale invasion of Ukraine. International ratings agencies have left the country, and the international edition of Forbes no longer includes Russian corporations in its lists.

The Insider has collected several illustrative examples from various sectors of the Russian economy. They highlight the range of economic experience under sanctions — from prolonged absences of profitability, to sudden declines in profit, to sustained and seemingly irreparable losses.

Gazprom is now an oil company

Gazprom has been severely impacted by the war — this despite the fact that Western countries have not sanctioned gas delivered by pipeline. The company recently reported its first losses in 25 years: a staggering 629 billion rubles (approximately $7.16 billion) in 2023 alone. While the explosion of both Nord Stream pipelines in September 2022 deprived Gazprom of one shipment route to European markets, the Russian government’s tax take of 600 billion rubles also contributed to the gas giant’s poor balance sheet performance.

What’s more, it is the company’s gas business that is unprofitable. While China could potentially replace Europe as a major buyer, a new gas pipeline is needed. Europe was supplied from West Siberian fields, whereas China is supplied from East Siberian fields through the Power of Siberia-1 pipeline. The proposed Power of Siberia-2 pipeline, which Beijing is in no hurry to approve, would connect these fields.

Despite a sharp decline in foreign market sales, Gazprom is sustaining domestic consumption. Of the 359 billion cubic meters of gas it produced in 2023, 215 billion cubic meters were consumed domestically. The company has been unable to significantly reduce operating costs despite decreased production due to the simple fact that maintaining idle infrastructure is still costly.

Gazprom Energoholding, on the other hand, a division that owns and operates power stations, remains profitable, as does Gazprom Neft, its oil producer. “The oil business for Gazprom is now almost more important than [its] gas business,” Sergey Vakulenko, ex-head of Gazprom Neft's strategy and innovation department, said in May following the release of the company’s latest earnings report.

Valery Andrianov, an associate professor at the Financial University in Moscow, points out that if oil and energy contributions are excluded from Gazprom's pre-tax revenue, its income would be right around half that of Novatek — Russia’s second-largest natural gas producer. “In other words,” Adrianov quipped, “the largest gas company in the country today is Novatek.

Russia’s largest gas company today is not Gazprom, but Novatek

Liquefied natural gas (LNG), Novatek's specialty, offers greater flexibility, allowing the firm to change markets quickly. For example, the company ramped up supplies of LNG to the EU when pipeline gas supplies declined. While Novatek’s new Arctic LNG-2 project saw its shipments postponed due to U.S. sanctions in 2023, the Novatek-led joint venture Yamal LNG remains unsanctioned — and it continues to operate. Novatek has remained profitable, earning 463 billion roubles ($5.27 billion) in 2023 while continuing to pay out dividends to shareholders.

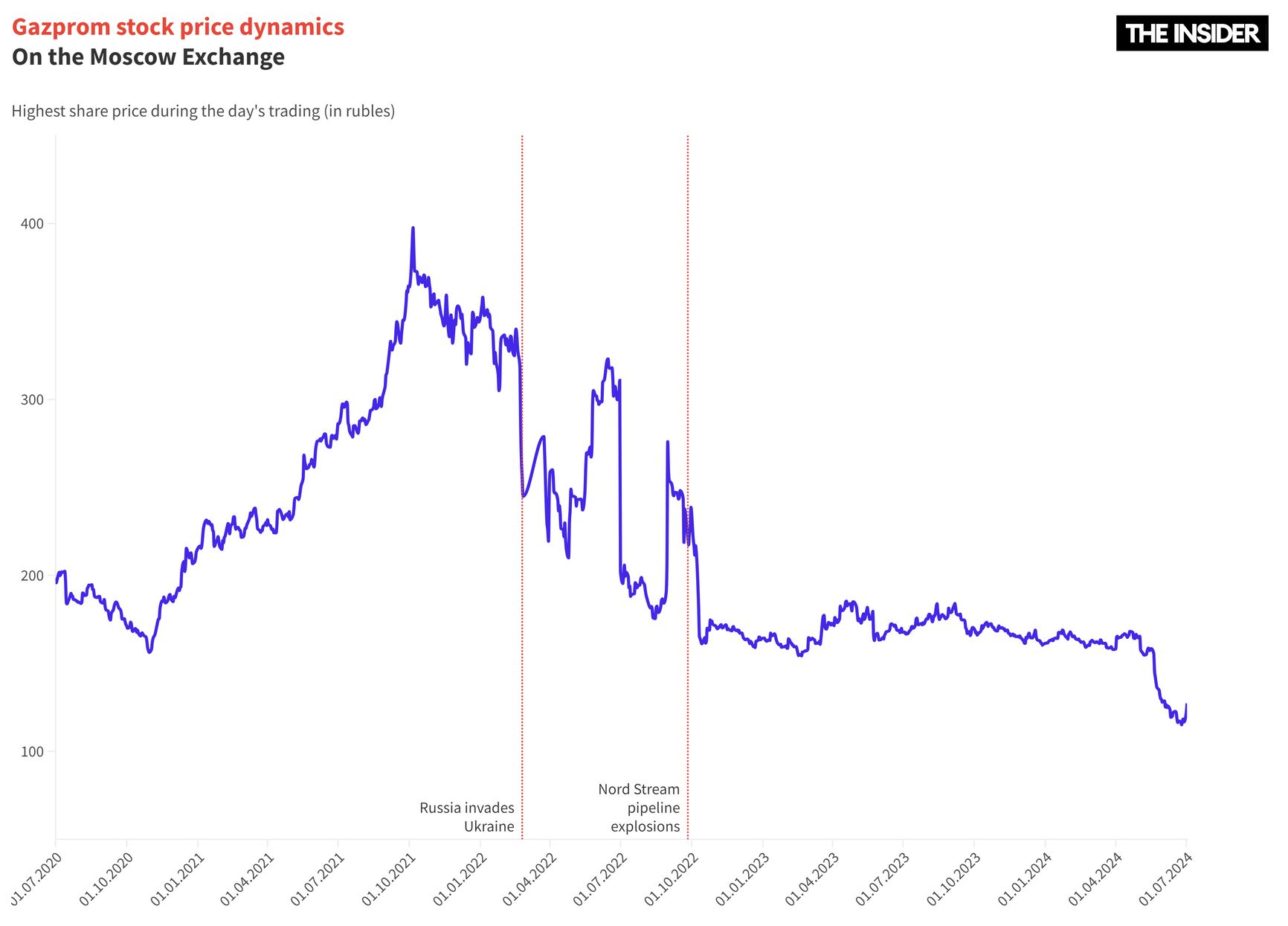

In contrast, Gazprom has not paid annual dividends for three consecutive years. The last interim dividends were paid out in 2022, with investors receiving a record 1.2 trillion rubles in the first half of the year. The latest dividend suspension has negatively impacted Gazprom's share price, which has dropped by 30% in recent months. Gazprom stock reached a peak of 367 rubles in October 2021, four months before Russia launched its full-scale invasion of Ukraine; it stands at 131 rubles today.

Despite these challenges, Gazprom's investment activity has not decreased. Capital investments in 2023 totaled 3.1 trillion rubles, up from 2.8 trillion rubles the previous year. Without profits and new shareholder investments, these funds must come from borrowing and depleting cash reserves, causing net debt to jump from under 4 trillion to 5.2 trillion rubles.

Valery Andrianov tells a popular joke that appeared in the aftermath of Gazprom's 2023 financial report: “since the company is a ‘national treasure,’ its debts will be divided equally among the entire population.” Most jokes contain a grain of truth and this one is no exception. The Russian government has already increased wholesale gas prices by 11.2% (tariffs for the population have increased by 8%), which will increase Gazprom’s revenue by 130 billion rubles. Another increase of 8.2% is expected in a year's time.

Russians will have to pay off Gazprom's debts: wholesale gas prices have risen by 11.2%, and another 8.2% increase is expected in a year's time

The turmoil for Gazprom does not end there. At the end of 2024, its contract for pumping gas through Ukraine expires. If the contract is not extended, Russia will be able to redirect only a small part of the lost volumes from Ukrainian transit to the Turkish Stream pipeline, which is already operating near capacity. In addition, the concern is expected to pay another 600 billion rubles in increased production tax. In the best case, Gazprom will be able to return to profitability — and to pay out dividends — in two years. Analysts believe it is too early to bury the company, even if it is still too scary to buy it.

Debt-ridden and bonus-less Aeroflot

Russia's largest air carrier was unprofitable before the war. In 2023, its losses, strangely enough, managed to shrink thanks to revenue growth. However, financial expenses — i.e. debt payments — tripled from 63 to 210 billion rubles. The airline itself explains the sharp rise in expenses mainly as the result of a “negative exchange rate revaluation” of leasing assets. In other words, due to the depreciation of the ruble, payments for imported aircraft denominated in foreign currency are growing rapidly. This resulted in a net loss — albeit one much smaller than that of the previous year. The company likewise refrained from paying dividends.

Sanctions in the form of a ban on the supply of airplanes and their spare parts to Russia have become a serious problem, as domestic manufacturers cannot replace them. Aeroflot will lose five million passengers in two years because of the delay in the delivery of Russian aircraft, the company's general director, Sergei Alexandrovsky, admitted. In March, the Russian aircraft industry once again pushed back the delivery dates of new Russian planes. As a result, Russian carriers were not able to generate the necessary cash flow to cover payments on obligations. Aeroflot’s debts already amount to more than 1.2 trillion rubles. Over the past year, they have grown by 15%.

Aeroflot's debts have grown by 15% over the past year

Equity capital remains negative due to accumulated losses. Moreover, short-term liabilities are growing at an accelerated pace — by 26% in 2023. These debts amounted to 354 billion rubles at the end of 2023, and by the end of the first quarter of 2024 — 367 billion. At the same time, current assets, which can be used to repay these liabilities, amounted to just 251 billion rubles at the end of last year, and by the end of the first quarter of this year, they had decreased to 237 billion.

Rusal asks for help from the government

The UK and U.S. have completely ceased importing Russian aluminum, copper, and nickel, and in the spring they imposed sanctions on trading in these metals on the Chicago Mercantile Exchange (CME) and the London Metal Exchange (LME). Rusal, Russia's largest aluminum producer, said at the time that global supplies would not be affected, as the company trades under long-term contracts and traders work on the exchanges. Indeed, Rusal has quietly extended its contract with Swiss trader Glencore for 2025 and is ramping up sales to China, where demand for green aluminum is high. The company's revenue in China doubled to $2.8 billion in 2023.

However, at the same time, Rusal was also asking for the Russian government to buy up to half of all exports for 2023 for placement in the state reserve, and also to exempt coloured-metal companies from the standard export duty. “We have high-quality aluminum, and I don't think that the refusal of America and England to buy our aluminum, where we have not supplied much (crumbs, one might say), will somehow affect the possibility of our deliveries to other countries,” Viktor Yevtukhov, deputy head of the Ministry of Industry and Trade, commented in April.

Rusal's CEO Oleg Deripaska reached an agreement with the US Treasury Department back in 2018 and reduced his stake from 70% to 44.95%, while he can vote with no more than 35% of the shares

Still, the Russian aluminum giant’s revenue fell 12% in 2023. Operating profit, which was more than $1.3 billion a year earlier, was replaced by a loss of $79m (the company reports in dollars, as its securities are traded on the Hong Kong stock exchange). Thanks only to the proceeds from stakes in other companies, Rusal’s net annual profit was positive — although it was significantly less than it had been in 2022: $282 million against $1.8 billion. The company blames global economic uncertainty, which weakened demand for aluminum, as well as “geopolitical tensions, including an unprecedented regime of external restrictions,” along with disruptions in supply chains and a significant drop in metal prices.

Rusal has also chosen not to pay dividends, though it is considering a share buyback. Following the start of the full-scale war, the company paid an interim dividend for the first half of the year 2022 before halting the payments.

Nornickel brings copper to China

Norilsk Nickel, also known as Nornickel, is Russia’s #2 player in the non-ferrous metals industry. It, too, recently reported a decline in net profit for the second year in a row. Compared to pre-war 2021, profits fell by more than half, to 253 billion rubles. Vladimir Potanin, the company's president, attributed the negative dynamics to lower prices, along with foreign political pressure. However, the company’s products still largely manage to reach world markets, and its revenue has not changed significantly since before the war.

At the same time, production costs rose by 45 per cent over the past year, partly because of the wage race. The company started spending one and a half times more on labor costs. In addition, due to sanctions and ruble depreciation, the equipment needed for production is becoming more expensive. Transport costs have more than doubled.

The problems are so acute that, according to Potanin, Nornickel plans to move the smelting capacity of the copper plant to China by 2027. This comes after modernization efforts were complicated by the impossibility of importing all of the necessary equipment to Russia. The Russian smelter was built under Stalin, is highly polluting, but nevertheless produces 80 per cent of the company's copper. Nornickel believes it would be more profitable to transport 2 million tonnes of copper concentrate to China annually via the Northern Sea Route.

Nornickel plans to relocate its smelting capacity to China by 2027

Nornickel will not pay dividends for 2023 either, although it has already paid interim dividends for 9 months of 2023.

Who’s better off?

The list of losers could go on. For example, in the woodworking segment, Segezha is unprofitable, and Ilim takes in only half of its pre-war profit. Not everything is great in ferrous metallurgy either: Mechel's profit for 2023 is three times lower than for 2022, and the debt burden continues to influence all the company's decisions.

But the losses of large Russian businesses are not the only story. Some industry leaders are showing positive results — and even growth. Rosneft increased its net profit, as did Sberbank and the X5 retail chain. The leaders of ferrous metallurgy, such as NLMK, have shown good results, as Vladimir Lisin's company increased net profit by 26% and paid dividends. Until 2024 it was not affected by sanctions, but the recently adopted EU package 14 may worsen the picture. The EU has imposed a ban on imports of Russian finished and semi-finished steel products, an important category for NLMK, whose European plants will not be able to receive billets from Russia and will have to restructure their business model.

Polyus, the country’s largest gold miner, also made more profit. Its management explained their decision not to pay dividends for the second year in a row by pointing to the company’s upcoming record investment programme. VTB Banking Group managed to move from losses to a record net profit of 432 billion rubles by the end of 2023. The growth was helped by the corporate sector, as companies actively took out loans despite the high Central Bank rate. Despite the record, VTB also did not pay dividends.

The economic difficulties faced by Russian businesses as a result of the war vary widely. Some, like Gazprom, have lost their most profitable sales areas. Others, like Rusal and Nornickel, are suffering from suboptimal production and logistics schemes, along with rising costs. Those such as Aeroflot have accumulated a heavy debt burden and are faced with dim prospects for servicing it. And the longer the war lasts, the deeper the problems of these and other Russian companies will become.