American artificial intelligence research organization OpenAI has called on the U.S. government to ban the use of an AI model developed by the Chinese startup DeepSeek, which shook up the market immediately after its launch in January. OpenAI, the maker of ChatGPT, argues that the Chinese project poses a national security threat, claiming it collects and transmits user data to Chinese authorities. In China, DeepSeek has been declared a national asset, and company employees have been restricted from traveling abroad. Despite the Trump administration’s efforts to slow China’s progress in high-tech industries, DeepSeek’s emergence shows that Beijing is catching up with Washington in artificial intelligence — prioritizing technological advancement over quick profits. However, state control and ideological constraints continue to hinder the development of Chinese AI projects. At the same time, DeepSeek’s arrival could serve as a powerful catalyst for American startups, which — benefiting from the presence of free-market competition — may yet be able to counter China’s challenge.

Content

Who is behind DeepSeek?

The start of a tech race

The nature of Chinese innovation

A turning point for the U.S.

Decades of U.S. tech dominance may be coming to an end. This January, the U.S. market experienced what prominent venture capitalist Marc Andreessen called a “Sputnik moment.” Just as the Soviet Union stunned America in 1957 by launching the Sputnik-1 satellite, thereby pulling ahead in the space race, China caught American investors off guard with the release of a new artificial intelligence model — DeepSeek — developed by a company of the same name.

DeepSeek didn’t just unveil its language model. It also published detailed technical papers outlining its architecture, infrastructure, and development costs — an unprecedented move in the otherwise secretive AI industry. The Chinese project demonstrated that training and deploying AI could deliver comparable performance despite costing a fraction of what industry leaders like OpenAI, the creator of ChatGPT, spend on their projects. The revelation sent shockwaves through the U.S. tech sector. According to Bloomberg, American companies lost nearly $1 trillion in market value in a single day — January 27.

Graphics processing units (GPUs) are far more powerful than central processing units (CPUs), enabling much faster training of large AI models.

U.S. companies lost nearly $1 trillion after DeepSeek’s latest release

AI researchers had taken note of DeepSeek nearly a year and a half before the so-called Sputnik moment. At the time, the U.S. was experiencing another surge of interest in AI, largely driven by the success of ChatGPT. Chatbots existed before OpenAI’s breakthrough, but only its model managed to produce responses that felt as if they were responding to user queries with awareness. Of course, this was merely an illusion of consciousness, but ChatGPT and similar models were trained to mimic human dialogue so convincingly that users easily accepted them as intelligent.

The success of ChatGPT convinced American investors that “strong AI” — capable of performing tasks at a human level — was within reach. The solution, they believed, was simply to acquire more graphics processing units (GPUs) and train even larger language models. Startups like OpenAI and tech giants such as Meta and Google threw themselves into the race for the most advanced AI, with each new breakthrough driving up company valuations.

Graphics processing units (GPUs) are far more powerful than central processing units (CPUs), enabling much faster training of large AI models.

The success of ChatGPT convinced American investors that “strong AI” — capable of performing tasks at a human level — was within reach

In the end, the pursuit of short-term profits overshadowed steady long-term growth. Even DeepSeek founder Liang Wenfeng has noted this trend, at least in his public statements, where he professes a commitment to technological progress over rapid capitalization. One way or another, Chinese projects like DeepSeek are now catching up with their American counterparts.

Who is behind DeepSeek?

DeepSeek presents itself as a small startup, but in reality, it is a project of one of China’s leading hedge funds — High-Flyer — founded by Liang Wenfeng. High-Flyer specialized in automated stock trading, attracting some of China’s top mathematicians. In 2020, the fund shifted its focus to machine learning. Wenfeng believes that only independent technological research can transform China’s approach from merely catching up to becoming truly innovative and original.

Graphics processing units (GPUs) are far more powerful than central processing units (CPUs), enabling much faster training of large AI models.

DeepSeek founder Liang Wenfeng

Such ambitions may be met with skepticism. After all, OpenAI also started as a nonprofit research group before its breakthrough with ChatGPT. So far, DeepSeek has not introduced any groundbreaking innovations. The project team has skillfully replicated competitors' language models, incorporating numerous technical tricks and refinements, but it has yet to present fundamentally new approaches, products, or business models.

Graphics processing units (GPUs) are far more powerful than central processing units (CPUs), enabling much faster training of large AI models.

DeepSeek has yet to produce true innovation

In a report on its latest model, DeepSeek stated that training costs amounted to just $5.6 million. The media seized on this figure, calling it a shockingly low price for computing. But this is misleading. The cost of training a single final model is only a fraction of the total expenses for such a project. It remains unknown how much the company spent on data collection, cleaning, storage, and extensive optimization experiments.

Overall expenditures could reach tens of millions of dollars — a solid achievement, but hardly revolutionary, despite how it has been portrayed in the press. For comparison, training Meta AI’s Llama 3.1 405B model is estimated to have cost $60 million. However, DeepSeek’s hardware expenses alone, according to some reports, may be as high as $500 million.

DeepSeek’s claims may be debatable, but one fact is undeniable: China has a strong talent pool in computer science. Results from recent International Mathematical Olympiads (IMO) show that the U.S. and China consistently vie for the top spots. There is even a joke that IMO is essentially a competition between Chinese students from China and Chinese students from the U.S. According to a 2024 report from the International Conference on Computer Vision and Pattern Recognition, Chinese universities significantly outpace American institutions in the number of accepted research papers, though the most frequently cited studies are still produced in the U.S.

The start of a tech race

Dario Amodei, CEO of Anthropic — a company founded by former OpenAI employees — frames competition with Chinese projects as an existential struggle between freedom and authoritarianism. In his essays, he predicts that without export controls on GPUs, China will develop military applications for AI and use them to reshape the global order. He warns that artificial general intelligence (AGI) could be just two or three years away.

Yet it was Chinese leader Xi Jinping who first launched China’s technological rivalry with the U.S. In 2017, China had its own Sputnik moment when Go champion Lee Sedol lost to Google-owned DeepMind’s AI model. Go was long believed to be beyond algorithmic mastery, and Lee’s defeat reportedly struck a nerve with Xi himself. After it, he set the goal of making China a world leader in artificial intelligence.

Graphics processing units (GPUs) are far more powerful than central processing units (CPUs), enabling much faster training of large AI models.

It was Chinese leader Xi Jinping who first launched China’s technological rivalry with the U.S. in 2017

China’s New Generation AI Development Plan set three key objectives: catch up with the U.S. by 2020, achieve a scientific breakthrough by 2025, and establish the country as the global leader in AI by 2030. The strategy has proven effective — state investments in corporations and education have helped companies like Baidu, Tencent, and Alibaba make significant advancements in facial and voice recognition.

These ambitions raised alarm bells during Donald Trump’s first stint in the Oval Office. To slow China’s technological progress, the U.S. launched a trade war, imposing sanctions on state-owned telecom giant ZTE. In 2018, U.S. tariffs were introduced on Chinese aluminum, steel, and other goods, along with sanctions against Huawei and DJI. The U.S. also tightened export controls on graphics cards, semiconductor chips, and manufacturing equipment — restrictions that continue to grow stricter today.

The nature of Chinese innovation

Both nations have their strengths. As the historical leader in technology, the U.S. dominates key platforms such as operating systems and semiconductor manufacturing. Despite China’s efforts to develop a homegrown OS (Kylin OS), American systems like macOS and Windows still account for 90% of the market in China itself.

In semiconductors, the U.S. wields significant leverage through sanctions, export controls, and incentives to attract chipmakers to American soil. The first Trump administration launched the so-called chip war, cutting China off from advanced microchips and sanctioning domestic semiconductor firms.

Following two rounds of tightened export controls in 2020 and 2022, China lost access to high-performance GPUs. Before the restrictions took effect, DeepSeek managed to acquire a cluster of Nvidia A100 processors, which were cutting-edge at the time. The company later published a study demonstrating its ability to train models using the less powerful, export-approved H800 GPUs. However, in 2023, the U.S. banned H800 exports to China as well.

Graphics processing units (GPUs) are far more powerful than central processing units (CPUs), enabling much faster training of large AI models.

Stricter U.S. restrictions have cut China off from access to advanced AI development technologies

Nvidia still allows China to purchase less powerful GPUs, but these are insufficient for achieving technological leadership. Domestic Chinese semiconductor development also suffers from U.S. sanctions and export controls on chip-making equipment. As Liang Wenfeng points out, money has never been an issue for DeepSeek. Instead, the real problem is the ban on importing high-performance graphics processors.

Both China and the U.S. rely heavily on venture capital to fund startups. While private investment funds specializing in high-growth industries exist in both countries, China also sees significant activity from state-backed investment organizations. Unlike their American counterparts, which focus on profitability and competitive project selection, Chinese state funds prioritize long-term programs. In other words, Beijing measures their projects’ success not by economic efficiency, but by strategic national development, job creation, and the advancement of state interests.

Graphics processing units (GPUs) are far more powerful than central processing units (CPUs), enabling much faster training of large AI models.

The success of Chinese state-funded projects is measured not by economic efficiency but by the advancement of state interests

This investment model has led to a dynamic that differs substantially from that of the U.S. In China, the government provides initial funding, reducing risks for early-stage companies. Private investors then step in at later stages. The approach works, with over 71% of Chinese venture startups following this model. However, by accepting state funding early on, companies risk losing their independence, as they must shift their focus from market needs to government ambitions.

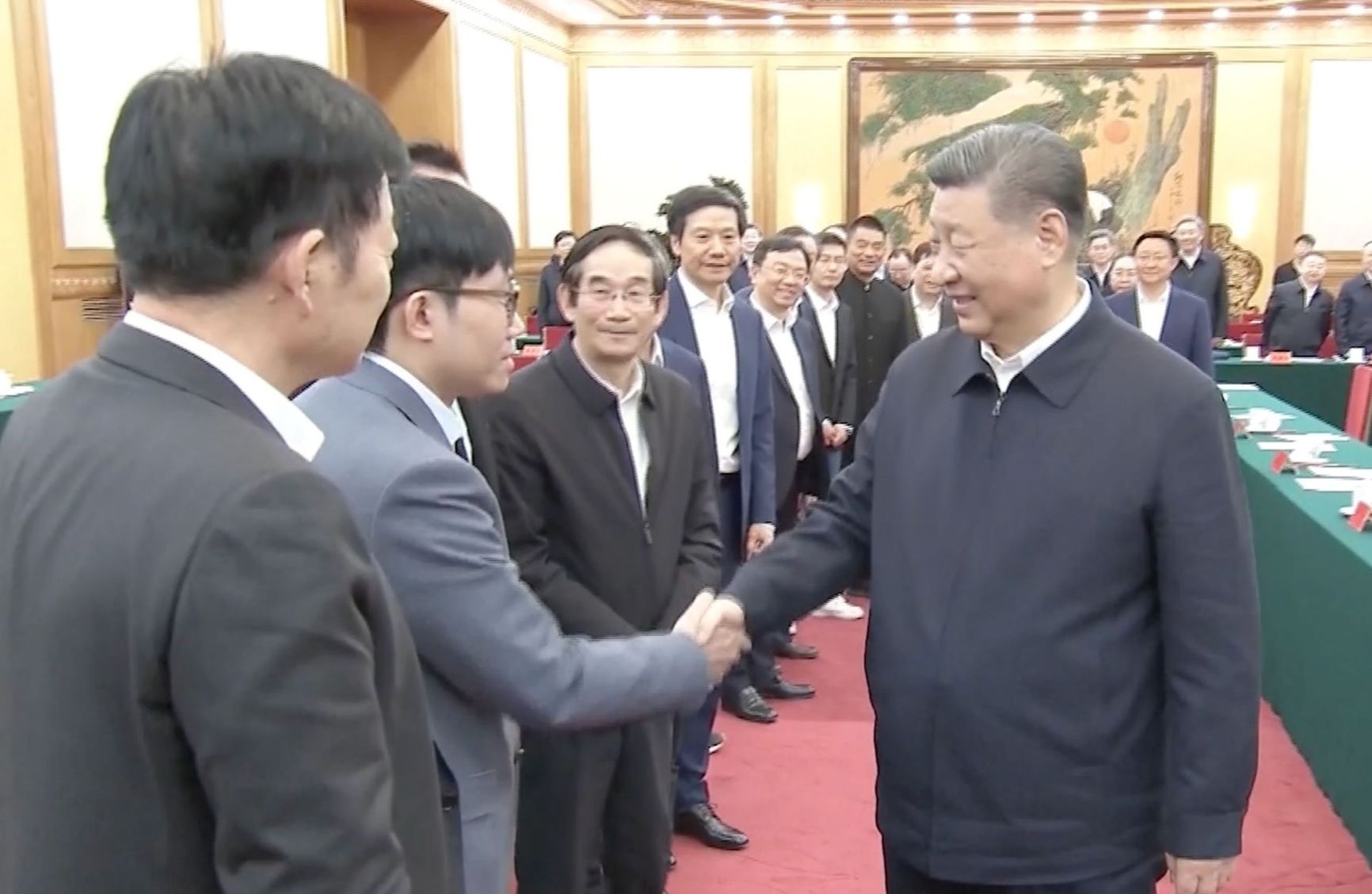

DeepSeek is unique in this regard: it was created entirely by a private hedge fund, without state involvement. But international recognition has certainly drawn the attention of the Communist Party. First came reports of a meeting between Liang Wenfeng and Premier Li Qiang, followed by one with Xi Jinping himself. Soon after, DeepSeek was declared a national asset, and rumors surfaced that its employees were being banned from traveling abroad.

Graphics processing units (GPUs) are far more powerful than central processing units (CPUs), enabling much faster training of large AI models.

Liang Wenfeng (left) meeting with Xi Jinping

Resisting such pressures is futile. A striking example is that of Jack Ma, the founder of Alibaba and once the model of a successful Chinese entrepreneur. In 2020, Ma criticized China’s rigid financial regulations and proposed reforms. The response was swift: he disappeared from public view for months, and in 2021, his company was fined $2.8 billion for monopolistic practices.

These developments have affected the country’s investment climate. Government funding comes with strings attached, and entrepreneurs who fail to produce a return risk losing their assets — along with the ability to leave the country. According to the Financial Times, funding for new Chinese startups has plummeted. In 2018, before the pandemic, more than 51,000 companies secured investments. By 2023, that number had dropped to just over 1,000. As a result, established companies thrive, but an entire generation of new startups may never emerge.

Graphics processing units (GPUs) are far more powerful than central processing units (CPUs), enabling much faster training of large AI models.

In 2018, before the pandemic, more than 51,000 Chinese companies secured funding. By 2023, that number had dropped to just over 1,000

Nevertheless, China continues to pour enormous sums into technological projects. One example is a new state fund worth $138 billion. Due to its centralized system, China can rapidly integrate government-approved projects into public infrastructure. Additionally, its vast domestic market of 1.4 billion users not only generates financial returns but also provides an immense amount of data for training AI models.

A turning point for the U.S.

Decades of cost-cutting by American executives through outsourcing to China have weakened U.S. industrial capacity. Both the previous and current administrations have pushed for reindustrialization. The 2022 CHIPS and Science Act, signed under Joe Biden, allocated $53 billion to domestic semiconductor production and brought Taiwan’s TSMC to Arizona. In January 2025, Donald Trump announced the Stargate Project, which plans to invest $500 billion in building data centers for OpenAI, all on American soil. Apple has also outlined a $500 billion investment in a Texas server factory and other industrial initiatives.

AI startups in the U.S. are now booming. Investor Marc Andreessen calls the emergence of DeepSeek a gift to Americans. Companies like OpenAI and Anthropic have slowed down competitors’ projects by restricting access to proprietary research. Now, with DeepSeek openly sharing its data, Silicon Valley startups can leverage it for their own needs, developing new services and business models.

Graphics processing units (GPUs) are far more powerful than central processing units (CPUs), enabling much faster training of large AI models.

DeepSeek’s emergence is seen as a gift to Americans because it does not conceal data about its developments

It is uncertain whether this wave of AI advancement will lead to the emergence of so-called “strong artificial intelligence.” Renowned robotics expert Rodney Brooks is skeptical, and even OpenAI’s Sam Altman urges people to lower their expectations by a factor of 100. However, one thing is clear: humanity has entered a new stage of technological evolution, and the world is about to change even faster.

Graphics processing units (GPUs) are far more powerful than central processing units (CPUs), enabling much faster training of large AI models.